some pretty big frackers are finally calling it quits, at least for the time being...for us here in Ohio, the most important is Chesapeake Energy, the 2nd largest US natural gas producer and the operator of more than half of Ohio's wells, and who is no longer drilling here; in fact, it has stopped drilling new wells in both the Marcellus and Utica Shale basins altogether, having released its last two Ohio rigs and its last Pennsylvania rig before the end of 2015...the company is trying to downsize in lieu of bankruptcy, and is planning to sell off its wells and land in a last ditch effort to stay solvent...although it hasn't specified which, if any, of its Ohio assets it will keep, it holds leases on more than a million acres in the Utica shale, probably more than all other Ohio operators combined...

at the same time, the two largest frackers in the Bakken formation of North Dakota, the nation's most productive shale basin outside of Texas, have both announced they're not going to complete any more of the wells that they've already drilled...both Continental Resources and Whiting Petroleum have said they'll continue drilling in the coming year, albeit at a much slower pace than in 2016, but that they wont be fracking any of the wells they drill in the Bakken until prices improve...their announcements, and that of Chesapeake, came as part of a raft of fracking 4th quarter reports to shareholders, which we'll be taking a look at shortly...

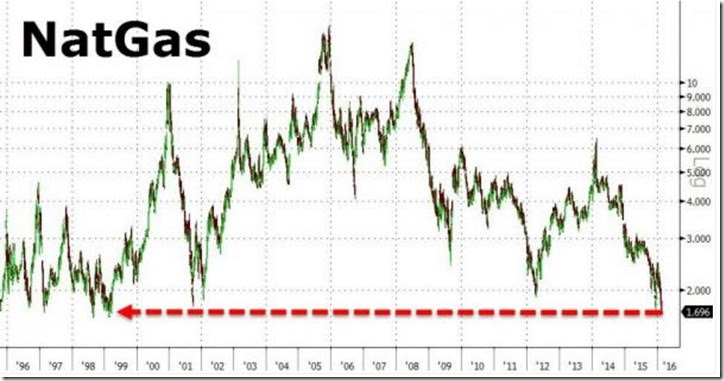

oil prices started the week by jumping more than 6% on Monday on a misreading and/or misreporting of an International Energy Agency (IEA) report that said that the oil glut would last well into 2017, longer than expected, but those price gains eroded later in the week after Saudi oil minister Ali Al-Naimi ruled out production cuts in a speech at a gathering of global oil executives in Houston, and hence oil closed the week at $32.87 a barrel, a price that is not comparable to last week's price, because the quoted price for oil rolled from the March contract price last week to the April contract price this week...meanwhile, natural gas prices hit a new 16 year low during the day on Thursday, but like oil, comparing the prices quoted this week to prior weeks is complicated by the month for which delivery is contracted...the contract for April delivery of natural gas at the Henry Hub in Louisiana closed at $1.785 per mmBTU on Thursday, certainly the lowest price for any April gas in 17 years, but it was still 3 cents higher than the closing price for January natural gas that we saw the week before Christmas...so while it was reported that natural gas prices hit a 17 year low, they didn’t close at one, because the December 17th closing price for January gas was actually lower, even more so, since natural gas is usually priced higher in the middle of winter...whatever the case, natural gas has certainly been at its lowest price ever on an inflation adjusted basis this winter, as we can infer from the following 20 year chart of natural gas prices taken from a Thursday article at Zero Hedge, calling out a 16 year low of $1.696 per mmBTU, following the Thursday EIA report of a smaller than expected drawdown of natural gas inventories...

4th Quarter and Full Year Earnings Reports

you might recall that last week we wrote about a new report from Deloitte auditors that forecast that more than a third of oil producers are probably heading for bankruptcy this year unless oil prices recover sharply, as they're no longer able to raise additional cash to pay their debts...they see that as many as 175 companies in the exploration and exploitation business, which have a combined total of more than $150 billion in debt, are likely to be heading for bankruptcy restructuring before the year is out....at the same time, past few weeks have seen the release of most of the 4th quarter and annual reports to shareholders for the oil majors & the independent drillers, which provide us a window into the financial condition of each of those companies...while we're not corporate analysts capable of determining which of them are in real trouble, we can take a look at some of those financial statements and at least get a sense of which are in the worst trouble by that metric, and whether their losses are becoming severe enough to shut them down or not....we'll start by looking at some of the vertically integrated major oil companies, who also have downstream oil refining and product marketing operations, and are likely to see that profitable side of their business make up for the losses on the exploration and exploitation side...

among the largest major oil companies, Exxon saw its 4th quarter profits fall by 58% from their year ago level, making for their worst quarter since the third quarter of 2002, as they postedearnings of $2.8 billion, down from $6.6 billion a year ago, on revenues of $59.81 billion, 31% lower than their year-ago revenue of $87.28 billion...for the year, their exploration and exploitation business fell from a profit of $6.3 billion to a loss of $1.1 billion, while the profits of their refining operations more than doubled to $6.6 billion, from $3.1 billion in 2014...with their 4th quarter report, they announced plans toreduce their capital and exploration expenditures in 2016 by 25% to $23.2 billion, compared with that of 2015, coming after they had already downsized their operations by 19% last year...reporting the same day, Chevron reported they lost $588 million on revenues of $28 billion, their first quarterly loss since 2002…for the year, Chevron's exploration and exploitation business fell from a profit of $3.33 billion to a loss of $4.06 billion, while their refining earnings were up 75% to $7.6 billion on higher gasoline prices in California.... Chevron had already cut $9 billion from its operating budget and capital spending last year, and planned a similar reduction for 2016...

of the major European based oil giants, BP reported a 91% plunge in their 4th quarter earnings, as their profits fell to $196 million, compared with profits of $2.2 billion in the 4th quarter a year ago; they also reported their largest ever annual loss, as they lost $6.5 billion on revenues of $55.9 billion in 2015, in contrast to profits of $12.1 billion on revenues of of $94.8 billion last year, as they had booked a $6.3 billion loss in the 2nd quarter relating to the Gulf oil spill....with their report, they also announced that they'd be cutting 7,000 jobs over the next two years, with 4,000 production and contractor job cuts initially, and another 3,000 jobs in its downstream units by the end of next year...at the same time, Royal Dutch Shell reported that their fourth-quarter earnings fell 56% to $1.83 billion, from $4.2 billion in the same period a year ago; for all of 2015, Shell's earnings fell 80 percent to $3.84 billion on revenues of $256 billion, compared with a profit of $19 billion in 2014...they also said that the layoffs they began last year will rise to 10,000 in 2016, as they'll be cutting operating costs by another $3 billion, on top of the $4 billion in cuts initiated in 2015...in addition, Norwegian energy giant Statoil posted a net loss of 9.2 billion kroner ($1.08 billion) in the fourth quarter, 3% greater than their 4th loss of a year ago, as their revenue fell to $12.8 billion from $17.3 billion, and the Spanish oil company Repsol reported it posted a net loss of 2.06 billion euros ($2.26 billion) in the fourth quarter, largely due to write-down of oil assets, in contrast to a loss of only 34 million euros in the same period of 2014

in contrast with the oil majors that have a large refining and retail presence, ConocoPhillips, which had refocused its business on exploration, production and distribution of oil, reported a fourth quarter net loss of $3.5 billion on revenue totaling $6.77 billion, compared with a fourth-quarter net loss of $39 million on revenue of $11.85 billion in 2014 (notice that their 2015 losses are more than half again as large as their revenues); they'll be cutting their capital spending to $6.4 billion from previously announced cuts to $7.6 billion, and slashing their quarterly dividend by 66 percent...in addition, Occidental Petroleum, the fourth-largest U.S. oil producer, reported a fourth-quarter loss of $5.14 billion, mostly from writedowns, on reported adjusted revenues of $2.84 billion, compared to an income of $17 million in the 3rd quarter of 2015 and an income of $317 million in the 4th quarter of 2014...

among the pure frackers, or the oil and gas exploration and exploitation companies without a refining or retail business, Anadarko Petroleum reported a loss of $1.25 billion in the fourth quarter and a loss of $6.69 billion for the year on revenues of just $8.698 billion, meaning they were losing more than 3 cents on top of every 4 cents they took in...Anadarko plans to cut their capital spending in half, to $2.8 billion in 2016...EOG Resources reported a fourth quarter net loss of $284.3 million, compared to a net income of $444.6 million in the fourth quarter of 2014...for the full year, Houston based EOG reported their first annual loss of $4.5 billion, in contrast to their net income of $2.9 billion for 2014...they'll also be cutting their 2016 capital expenditures by 50% and focusing on premium drilling and completions that can be profitable at prices they contracted for, expecting to complete 270 wells, 150 of which will be in the Eagle Ford, compared to the 470 wells they completed in 2015...

Continental Resources reported a 4th quarter loss of $139.7 million, compared with a year-earlier profit of $114 million, on 4th quarter revenues of $575.5 million....for the entirety of 2015, the company reported a net loss of $353.7 million, on revenues of $2.68 billion...the Oklahoma company, which also has major operations in the Bakken said it would slash planned capital spending this year by 66% and indicated further cuts could follow if needed...it also said it has stopped all fracking operations in the Bakken shale and has no stimulation crews deployed there, and plans to defer most well completions in 2016...meanwhile, Denver-based Whiting Petroleum, the largest operator in North Dakota's Bakken, posted a net loss of $98.7 million on revenues of $423.5 million., compared with a net loss of $353.7 million in the year-ago period, when they wrote down the value of their acreage throughout the US....they've slashed their operating budget by 80% and said they'd suspend all fracking operations until such time as crude prices moved higher; the $500 million they plan to spend in the first half of 2016 will be for expenses they'll incur in mothballing most of their operations; they expect to spend only $160 million thereafter, solely for maintenance...

lastly, Chesapeake Energy reported a net loss of $2.23 billion for the fourth quarter of 2015, on adjusted net revenue of $2.6 billion, compared with a net income of $586 million on revenues of $5.2 billion in the same period of 2014...in contrast to Whiting and Continental, who are deferring completions while they wait for higher prices, Chesapeake, with their back against the wall with bonds coming due and facing $1 billion in collateral calls, is going to focus on more well completion and less drilling; as we noted earlier, they've stopped drilling in Ohio and Pennsylvania completely...they also expect to sell assets worth between $500 million to $1 billion, and cut overall spending by 57%...so they're in the unenviable position of producing the most gas they can with gas prices at 17 year lows, and trying to off their natural gas and oil assets when prices for both commodities are at multi-year lows..

The latest EIA Oil Stats

US crude oil production was modestly lower again this week, but our imports of crude remained elevated and our refining pace slowed, and as a result our stores of crude oil rose to another new record... this week's Energy Information Administration data showed our field production of crude oil fell by 33,000 barrels per day, from 9,135,000 barrels per day during the week ending February 12th to 9,102,000 barrels per day during the week ending February 19th...that was 2.0% below the 9,285,000 barrels per day we were producing in the third week of February last year, and except for three weeks in September and October at 9,096,000 barrels per day, the lowest our oil production has been since November 2014, so it seems low prices are finally taking a toll on what our domestic oil companies are willing to bring up from the ground.....

meanwhile, our crude oil imports, the other major source of our domestic crude supply, slipped to an average of 7,802,000 barrels per day during the week ending February 19th, falling by 117,000 barrels per day from the average of 7,919,000 barrels per day we imported during the week ending February 12th...while this week's imports were 7.2% above the 7,279,000 barrels per day we were importing during the week ending February 20th last year, imports are too volatile on a weekly basis for such a comparison to give us a good sense of the year over year change, so the weekly Petroleum Status Report (62 pp pdf) reports a 4 week moving average of imports, which showed our oil imports have averaged 7.8 million barrels per day over the last 4 weeks, 7.0% above the same four-week period last year...

however, even with domestic supply thus down a bit from last week, refineries also slowed down during the period, processing 15,685,000 barrels per day during the week ending February 19th, 163,000 barrels per day fewer than the previous week’s average, as the US refinery utilization rate fell to 87.3%, down from the 88.3% refinery utilization rate during the week of the 12th, and down from a refinery utilization rate as high as 94.5% at the end of November..in the same week a year ago, refineries processed 15,243,000 barrels per day, using 87.4% of the country's refining capacity, so such a slowdown is fairly normal for this time of year, as refiners are beginning the process of switching over to their summer blends...

but even with less crude being refined, our refinery production of gasoline rose by 334,000 barrels per day to 10,009,000 barrels per day during week ending February 19th, 3.6% more than the 9,659,000 barrel per day gasoline production of the week ending February 20th last year, and only the 6th time in history our gasoline output topped the 10 million barrels per day threshold....meanwhile, our output of distillate fuels (ie, diesel fuel and heat oil) fell by 225,000 barrels per day to 4,438,000 barrels per day during week ending the 19th, which was also down by 309,000 barrels per day from our distillates production during the same week a year ago...however, even with the increase in gasoline production, there was an even larger increase of 373,000 barrels per day in demand for that product, and as a result we saw the first drop in our supply of gasoline in storage in 15 weeks, as our gasoline stockpiles fell by 2,236,000 barrels from last week's record high to 256,457,000 barrels as of February 19th...that was still 6.9% higher than the 240,014,000 barrels we had stored at the same time last year, and, except for last week, the largest gasoline stores we've ever accumulated in the recent history tracked by the EIA...during the same week, our distillate fuel inventories also fell, decreasing by 1,669,000 barrels to a total of 160,715,000 barrels as of February 19th.....but because of the mild winter, our stocks of distillates remain above the upper limit of the average range for this time of year, measuring 28.9% higher than the 124,698,000 barrels we had stored during the same week last year..

so, while we didn't have new records for stored gasoline or any other refinery products, the ongoing level of excess crude imports combined with less refining did leave a lot of unused oil sloshing around in the Gulf Coast states, and as a result our stocks of crude oil in storage, not counting what's in the government's Strategic Petroleum Reserve, rose once again to a new record of 507,607,000 barrels as of February 19th, up by another 3.5 million barrels from the record 504,105,000 barrels we had stored at the end of the prior week...as we've pointed out repeatedly, the crude we have stored now is far more than we've ever had stored in the 80 years of EIA record keeping, which first saw the 400 million barrel level breached in the 3rd week of January last year...for a visual of that, we'll include a picture of the most recent 15 years of the interactive graph that is included with the EIA tables on our weekly crude oil supply:

This Week's Rig Count

for the first time in 4 weeks, cutbacks in working drilling rigs were less than 5% of the preceding week's active rig tally ...Baker Hughes reported that the number of active drilling rigs working in the US fell by just 12 to 502 rigs as of February 26th, down from the 1267 rigs that were drilling for oil or gas in the same week a year ago, and down from the recent rig count peak of 1931 rigs that were being worked on September 26th of 2014....13 rigs that had been drilling for oil were shut down this week, leaving 400, down from the 986 oil rigs that were deployed on February 27th last year, and down from the fracking era high of 1609 oil drilling rigs that were working on October 10, 2014...but even with natural gas prices at a 17 year low, someone out there added a rig to drill for it, as gas rigs were up by 1 to 102 for the week, still down from the 280 gas rigs that were working a year ago...

likewise, rigs on 2 additional oil platforms started drilling in the Gulf of Mexico, bringing the active Gulf total back up to 27...that's still down from 49 drillers in the Gulf and a total of 51 rigs working offshore a year ago, but with the long lead time on such drilling, this count has been holding steady in the mid 20s range for several months now...otherwise, both horizontal and directional rig counts decreased, while vertical rigs were up by 8 to 58, which was still down from 194 vertical rigs that were in use on February 27th of 2015...a net of 19 horizontal rigs were stacked this week, leaving 397, down from the 946 horizontal rigs that were working in the US the same week a year ago, and down from the recent high of 1372 horizontal frackers that were drilling on November 21st of 2014...in addition, the week's directional rig count fell by 1 to 47, down from the 127 directional rigs that were in use a year ago....

of the major shale basins, the Eagle Ford of south Texas saw 7 rigs pulled out this week; leaving the Eagle Ford with 47 rigs, down from 157 a year earlier...in addition, the Arkoma Woodford of Oklahoma, the Granite Wash of the Oklahoma-Texas panhandle region, the Haynesville of Louisiana, the Permian of west Texas and the Utica of Ohio all had one rig pulled out; those reductions left Arkoma Woodford with 4 rigs, down from 5 rigs last week and a year ago, left the Granite Wash with 9 rigs, down from 34 a year ago, left the Haynesville with 14 rigs, down from 40 on the same weekend last year, left the Permian with 164, down from last February 27th's 355 Permian rigs, and left the Utica with 12 rigs, down from 38 rigs in the Utica last year at this time...meanwhile, 3 rigs were added in the Cana Woodford of west central Oklahoma, bringing the total count there up to 36, still down from 39 a year earlier, and a rig was added in the Barnett shale, which underlies the Dallas -Ft Worth area of Texas, where there are now 4 rigs, down from 9 a year ago...

the state count tables show Texas with 5 fewer rigs, down from 236 last week and down from 570 a year ago; New Mexico shed 3 rigs, and now has 18 rigs, down from the 68 that were deployed in the state a year ago...both Alaska and California were down 2 rigs this week; the former is now down to 11 from 12 rigs a year ago, while the latter is now down to 6 rigs from 15 a year earlier....there were also single rig reductions in Ohio, Utah, and Wyoming; Ohio now has 12 rigs, down from 36 a year ago; Wyoming has 9 rigs running, down from 33 a year earlier, whereas Utah is now completely rig free, with all 11 rigs running there a year ago now gone...still, Louisiana saw the addition of the 2 rigs in their Gulf of Mexico waters, bringing the state count up to 47, still down from 102 a year ago, while single rigs were also added in West Virginia and Kentucky...West Virginia now has 13 rigs, down from 16 last year, while Kentucky shows 2 rigs drilling, the same number that were drilling in Kentucky on February 27th of 2015...